Kidney failure changed the course of my life. I began dialysis, the exhausting treatment kidney failure patients need to survive, three months pregnant with my son. I received a kidney transplant, which ultimately failed, and I have been on dialysis for a total of nine-and-a-half years. It’s been an arduous journey.

Dialysis costs upwards of $100,000 per year, so most patients rely on some combination of Medicare, Medicaid, private insurance and charity. I began dialysis as a young adult, so I needed Medicaid immediately, but many others begin with employer-provided private insurance.

As I’ve learned over the course of my time on dialysis, those with private insurance benefit immensely. They receive wider options for doctors and medications and secure transplants more quickly. While I didn’t have the benefit of being on private insurance, I believe kidney patients with private insurance should be allowed to keep it.

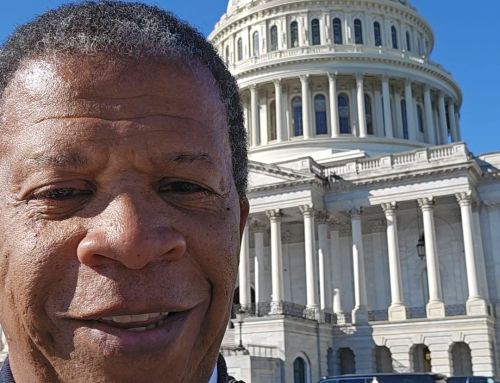

However, a recent Supreme Court decision may allow private insurers to push high-cost kidney patients off their plans before they’re ready to transition to Medicare. This is leaving patients with fewer options and astronomical bills. U.S. Rep. Glenn Grothman must support the Restore Protections for Dialysis Patients Act, which will reverse this trend and allow patients to keep their private insurance for the initial 30 months of care.